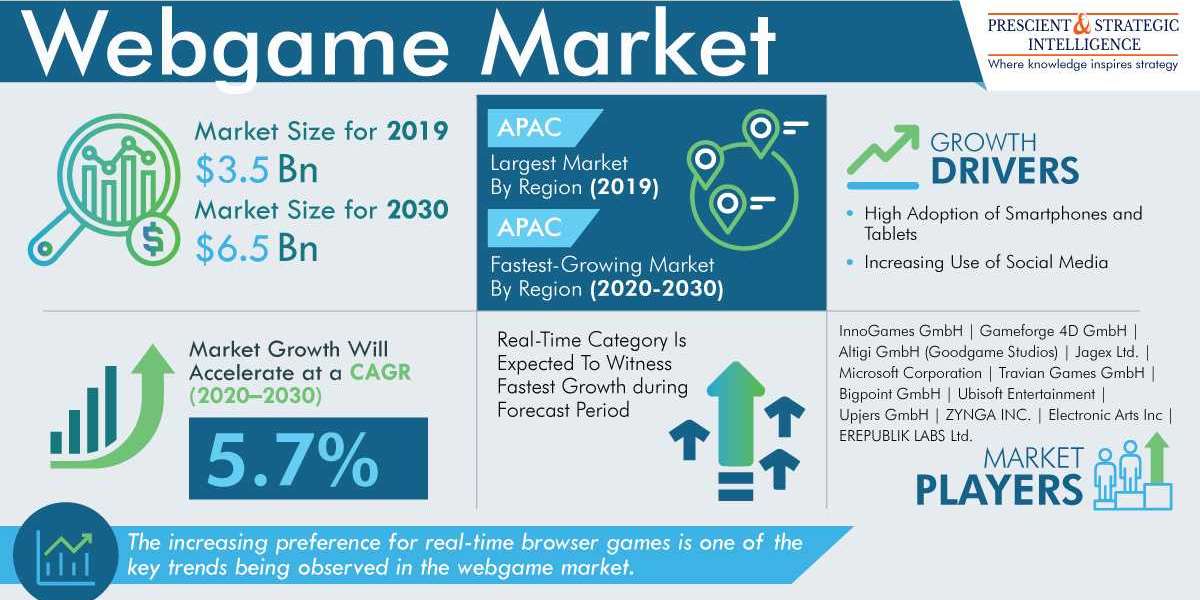

Compared to 60% in 2018, 79% of the people around the world would have smartphones by 2025, according to GSMA Intelligence. This is expected to be the key driver behind the steady growth of the global webgame market, from $3.5 billion in 2019 to $6.5 billion in 2030, at a 5.7% CAGR between 2020 and 2030.

The webgame market is majorly being propelled by the adoption of better processors supporting higher speeds, larger screens, and HD displays, which have turned smartphones into gaming consoles of sorts. Moreover, with the 4G and 5G networks being expanded around the world, people are facing few connectivity problems.

The webgame market is growing during the COVID-19 pandemic, as owing to the lockdown implemented around the world, people are not stepping out of their houses much. In such a scenario, they are turning to TV and other forms of digital entertainment, including online games. Historically, the number of players on online gaming portals witnesses a decline after the December holiday season, but during the period following 2020 New Year’s Day, the number of browser game players has shattered all previous records.

Webgame Market Segmentation Analysis

In the years to come, the individual bifurcation will keep holding the larger share in the webgame market, on the basis of player type. Compared to multiplayer variants, single-player website games offer people more freedom. Further, the decision making, on the part of players, does not depend on other human users, which makes these online games more popular.

Real-time was the largest category in the webgame market in the past, based on gameplay. By allowing for real-time inter-player interaction, such online games offer more thrill and faster gameplay and allow people to make decisions on the spot.

In the immediate future, the free to play division is projected to witness the higher CAGR in the webgame market, of 6.2%, under segmentation by model. As people do not have to pay anything to play these games, they are more preferred. Owing to the higher visitor count on free-to-play online gaming websites, companies across industries advertise on them, which translates into higher revenue for publishers offering such browser games, than those charging gamers.

The webgame market was dominated by the 25–34 category, under the age group segment, historically. People under this age group are increasingly spending on browser games on account of their growing disposable income. In addition, the number of women gamers aged 25 to 34 is rising, which is further making this age group the largest online gamer. Due to the short sessions of Candy Crush, Bejeweled, and other such website games, women under this age group are getting attracted to them.

In the coming years, the popularity of the first-person shooter genre would increase the fastest in the webgame market. As such games do not let players see the character they are controlling, from behind, they offer a more realistic experience. Further, people are preferring these games because of their shorter sessions and greater thrill.

Asia-Pacific (APAC) is the largest webgame market currently, and the next 10 years will be characterized by the same situation. The increasing penetration of mobile phones, laptops, and tablets has opened new avenues for the large gaming population in the region, in terms of the platforms they can play games on. Additionally, the increasing purchasing power in the region is allowing people to opt for payable games; for instance, the per capita disposable income in India grew by 10% between FY2017–18 and FY2018–19.

Market Players Engaging in Mergers and Acquisitions to Grow Faster

Players in the webgame market are entering into mergers and acquisitions to augment their growth rate, with most of these moves aimed at:

- Strengthening their channel strategy

- Offering role-playing games replete with adventure and action

- Gaining access to programming expertise, games portfolio, and registered users

- Providing companies with a wide range of advertising solutions on their games

- Expanding their geographical footprint

The most significant businesses in the global webgame market include Ubisoft Entertainment, Jagex Ltd., Altigi GmbH, InnoGames GmbH, Bigpoint GmbH, Travian Games GmbH, Microsoft Corporation, Electronic Arts Inc., Upjers GmbH, and Zynga Inc.

Source: PS Intelligence